Credit Scores and Credit History

Community Capital New York provides all entrepreneurs and small business owners with a path forward to accessing capital. Though Community Capital New York does not solely base its lending on credit, it is crucial for small business owners and entrepreneurs to understand and practice healthy credit practices. Community Capital New York strongly recommends that each small business owner and entrepreneur:

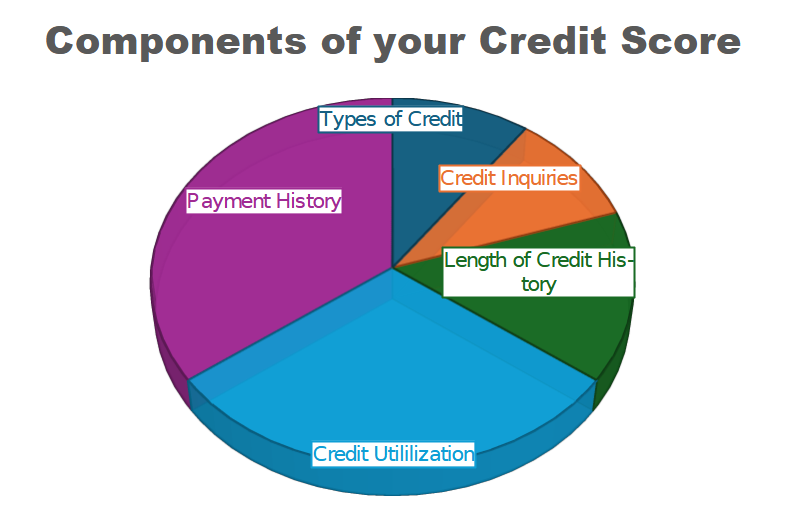

- Know the components of their credit score.

- Always be familiar with their credit history.

- Make efforts to actively improve or repair their credit.

- Stay up to date on resources and information regarding consumer reporting companies.

What is the difference between Credit Score and Credit History?

A credit history report will provide someone with a statement with all the activity in their credit. Lenders such as Community Capital New York will use a credit history report to determine if someone has the income that is needed to repay the loan they are seeking. Anyone may request a free copy of their credit history report using AnnualCreditReport.com